Your wallet is like a tiny fortress for your most important items. But some things you’re carrying might actually be putting you at risk.

We’re diving into the items you should never keep in your wallet and why. These everyday objects can expose your personal information, leave you vulnerable, or just make life harder than it needs to be.

Some items on this list might surprise you, while others are obvious culprits. Either way, it’s time to lighten the load and keep your security in check.

1. Social Security Card

Your Social Security number is a prime target for identity thieves, and losing access to it can lead to significant risks, such as someone opening credit cards or filing tax returns in your name. Keep your Social Security card in a safe place at home and memorize the number.

2. Birth Certificate

Your birth certificate is another document that should stay far away from your wallet. It’s a key piece of identification that, in the wrong hands, can be used to steal your identity. There’s rarely a need to carry this around day-to-day. Store it in a secure location at home, like a fireproof safe. If you need it for official business, take it only for that specific errand and return it to its safe place immediately after.

3. Passport

Unless you’re traveling internationally, your passport should stay at home. It’s a valuable document that’s expensive and time-consuming to replace if lost. In some countries, a stolen passport may be valuable for illegal activities, such as identity fraud or forgery. Keep your passport locked up at home. If you’re traveling abroad, consider using a hidden money belt or leaving it in your hotel safe when you’re not actively using it.

4. All Your Credit Cards

Carrying every credit card you own is asking for trouble. If your wallet is stolen, you’ll have to cancel all of them, leaving you without access to credit. Pick one or two cards to carry daily. Leave the rest at home. This way, if your wallet is lost or stolen, you’ll still have access to credit and won’t have to go through the hassle of canceling and replacing every card you own.

5. Blank Checks

Blank checks are an identity thief’s dream. With your account and routing numbers, a thief can drain your bank account or create fraudulent checks. If you need to write a check, bring just the one you need. Better yet, use online bill pay or electronic transfers when possible. Keep your checkbook secure at home and only carry checks when absolutely necessary.

6. PIN Numbers

Never keep a written record of your PIN numbers in your wallet. If a thief gets your debit card and PIN, they can empty your bank account in minutes. Memorize your PINs instead. If you must write them down, disguise them as phone numbers or addresses in a separate notebook kept at home. Never store them with the corresponding cards.

7. House Keys

Your house keys don’t belong in your wallet. If your wallet is stolen, a thief could find your address from other items and use the keys to enter your home. Keep your keys on a separate key ring. If you’re worried about losing them, consider a Bluetooth tracker that can help you locate misplaced keys. This way, your home stays secure even if your wallet goes missing.

8. Work ID Badge

Your work ID badge can give thieves access to your workplace and potentially sensitive information. Unless you need it to enter your building, leave it at work or in your car. If you must carry it, keep it separate from your wallet. This protects both your personal information and your employer’s security.

9. Library Card

While library cards seem harmless, they could still be used fraudulently. If you’re not using your card, leave it at home or opt for a digital version available from many libraries.

10. Gift Cards

Gift cards are essentially cash. If your wallet is stolen, you’ll lose the full value of any gift cards inside. Keep gift cards at home until you’re ready to use them. If you receive a gift card you don’t plan to use soon, consider selling it online or exchanging it for cash. This way, you’re not carrying around money you can’t easily replace if lost.

11. Receipts

Receipts often contain partial credit card numbers and other personal information. Thieves can use these details for fraud or to piece together your spending habits. Empty your wallet of receipts regularly. If you need to keep them for returns or expense reports, store them in a designated place at home. Consider using digital receipt apps to keep track of your purchases without the paper clutter.

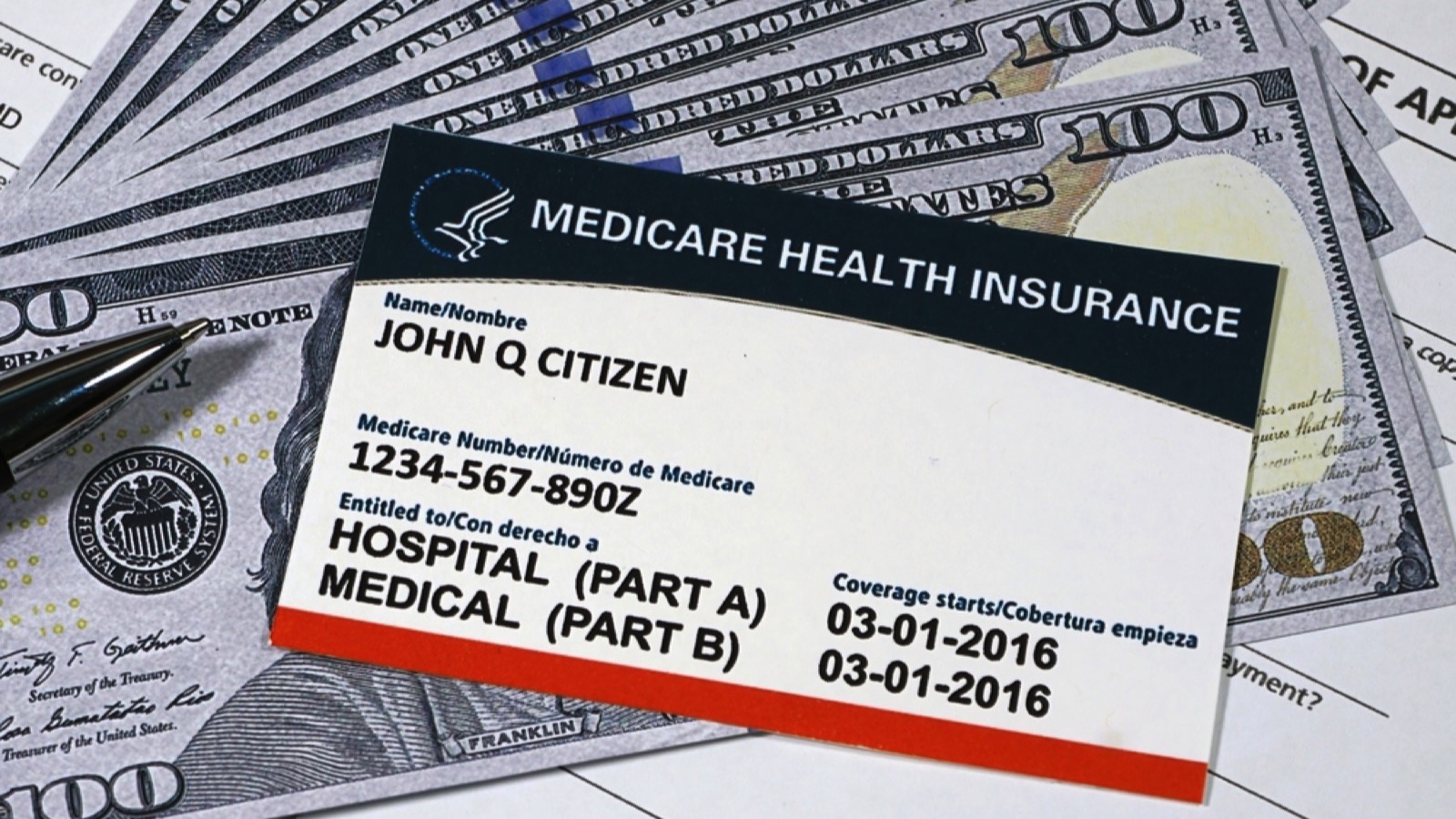

12. Medicare Card

Medicare stopped using Social Security numbers on new cards starting in 2018, but if you have an older card with your Social Security number, leave it at home. Carry a photocopy with the last four digits of your Social Security number blacked out instead.

13. Insurance Cards

While it’s smart to have your current health insurance card with you, older cards or cards for other types of insurance don’t need to be in your wallet. They often contain sensitive information that could be used for identity theft. Keep only your current health insurance card with you. Store other insurance documents securely at home and access them digitally if needed.

14. Spare Car Key

A spare car key in your wallet might seem convenient, but it’s a huge risk. If your wallet is stolen, the thief now has access to your car too. Keep your spare key at home or with a trusted friend or family member. If you’re worried about locking yourself out, consider a magnetic key box hidden on your car’s exterior or a keyless entry system.

15. Password List

Never keep a list of passwords in your wallet. This is like handing over the keys to your digital life if your wallet is stolen. Use a secure password manager app instead. These apps encrypt your passwords and can be accessed from your phone or computer with a single master password. This keeps all your login information safe and easily accessible without the risk of physical theft.

31 Ways to Boost Home Security: How to Fortify Your Fortress and Deter Burglars

We sadly live in a society where it’s all too common for criminals to want to take what we’ve worked hard to get. The results of a break-in are traumatic, too. Beyond just losing your stuff. Victims often feel violated, anxious, and unsafe, sometimes for years after the event.

Prevention is the best way to stay safe. And, while you shouldn’t have to turn your home into a fortress, that’s the stark reality of our world. But you can take plenty of simple steps to deter burglars and ensure your home is less attractive to would-be thieves.

12 Money Mistakes That Can Leave You Vulnerable in a Crisis

In times of uncertainty, financial stability is more crucial than ever. While prepping for physical emergencies is vital, don’t overlook financial prepping. Avoiding these common money mistakes can help make sure you’re in a stronger position to weather any storm.

Surviving the Crash: 17 Hot Takes on Crypto in a Post-Collapse World

With recent global unrest and economic uncertainties, many people are starting to worry about the stability of our money. They’re looking for new options like cryptocurrencies. Using digital money might sound strange, but it’s becoming more common. Big names like Bitcoin and Ethereum are leading the way. This article will look at how cryptocurrency could change things in a shaky economy. We’ll discuss the good and bad sides of using digital money. Get ready to learn about the crypto world and how it might affect our financial future!