Think you’ve got retirement all figured out? Remember, these myths could ruin your golden years if you’re not careful.

Retirement planning is full of misinformation and misconceptions that can lead you astray. Understanding and debunking these myths is crucial for building a secure and enjoyable retirement.

We’ve highlighted these myths for their potential to significantly impact your retirement strategy. By focusing on widely held but flawed beliefs, this article aims to steer you clear of common pitfalls. We avoided less common misconceptions that might not affect most retirement plans.

1. You Need $1 Million to Retire Comfortably

The idea that everyone needs a million dollars to retire comfortably is a common misconception. Your retirement needs depend on your lifestyle, location, and health. Some people might need more, while others can retire comfortably on less. Focus on your personal retirement goals and expenses rather than an arbitrary number.

2. Social Security Will Cover All Your Needs

Relying solely on Social Security for retirement is a risky move. The average Social Security benefit is much lower than most people’s working income. It’s designed to supplement retirement savings, not replace them entirely. Plan to have additional sources of income to maintain your lifestyle in retirement.

3. You Can Catch Up on Savings Later

Postponing retirement savings is a dangerous game. The power of compound interest means that starting early, even with small amounts, can lead to significantly more growth over time. Playing catch-up in your 50s or 60s often requires much larger contributions to reach the same goals.

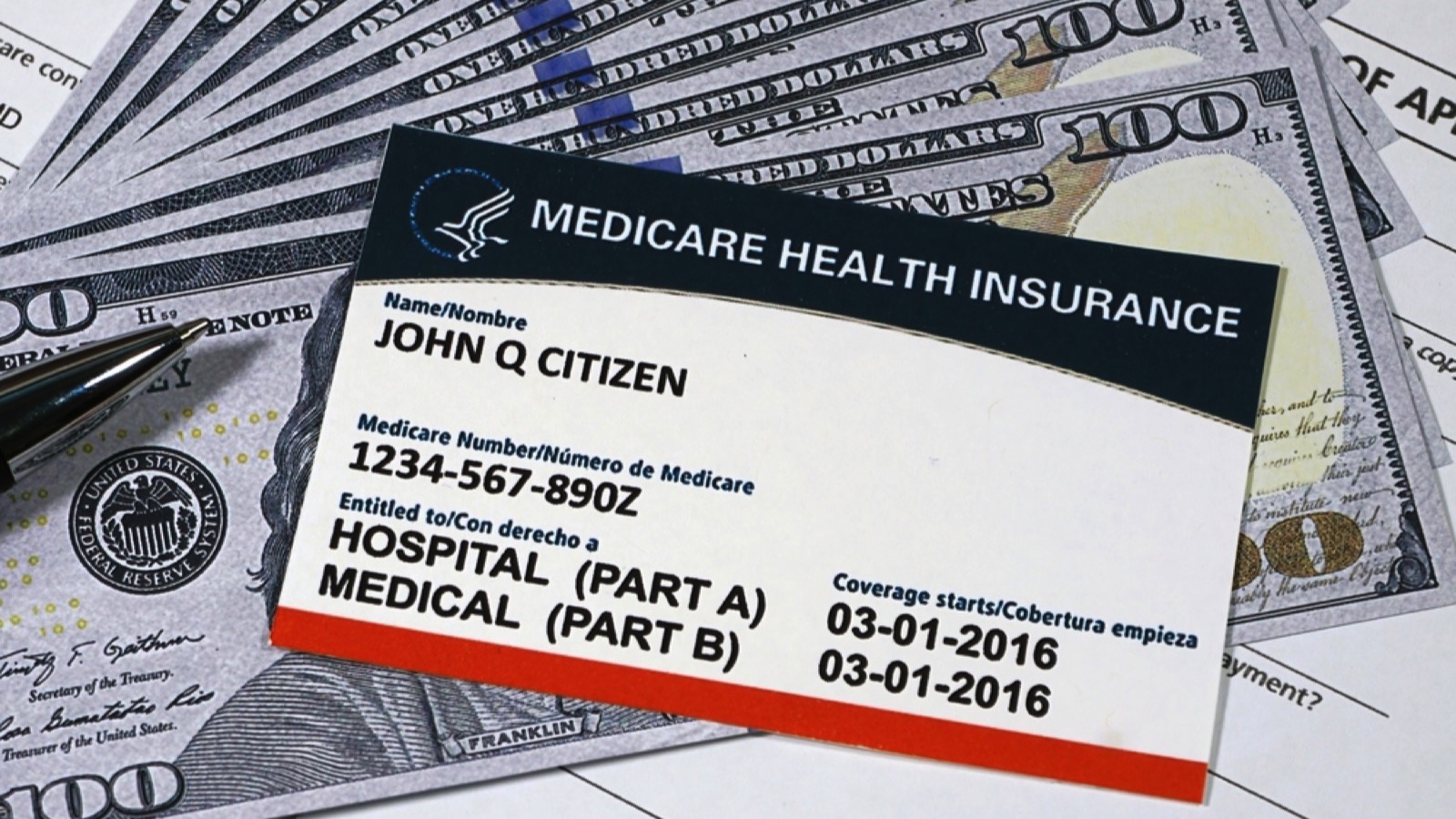

4. Medicare Will Cover All Your Healthcare Costs

Medicare is a valuable resource, but it doesn’t cover everything. Many people are surprised by out-of-pocket costs for prescriptions, dental care, and long-term care. Budget for additional healthcare expenses in retirement, including supplemental insurance policies to cover gaps, such as Medigap or Medicare Advantage plans.

5. You’ll Spend Less in Retirement

The idea that retirees automatically spend less is often false. While some expenses might decrease, others, such as travel, hobbies, and healthcare, can increase. Create a realistic retirement budget that accounts for your desired lifestyle and potential increased expenses.

6. Downsizing Your Home Will Solve Everything

While downsizing can free up equity and reduce expenses, it’s not always the financial windfall people expect. Moving costs, renovations, and the current housing market can eat into potential savings. Carefully weigh the pros and cons before banking on downsizing as your retirement solution.

7. You Can Work as Long as You Want

Planning to work into your 70s or beyond isn’t always realistic. Health issues, job market changes, or family responsibilities might force an earlier retirement. It’s wise to plan for the possibility of retiring earlier than expected, even if you intend to work longer.

8. Investing Is Too Risky as You Get Older

While it’s true that your investment strategy should become more conservative as you age, avoiding risk entirely can be detrimental. Inflation can erode the value of overly conservative investments. A balanced portfolio that includes some growth potential is often necessary to maintain your purchasing power throughout retirement.

9. You Don’t Need Life Insurance in Retirement

Life insurance needs don’t automatically disappear in retirement. If you have dependents, outstanding debts, or want to leave a legacy, life insurance might still play a crucial role. Evaluate your specific situation to determine if continuing life insurance coverage makes sense for you.

10. Your Taxes Will Be Lower in Retirement

Many retirees are surprised to find their tax bills don’t decrease as much as expected. Withdrawals from traditional retirement accounts are taxed as income, and Social Security benefits might also be partially taxable. Understanding and planning for your tax situation in retirement is crucial for accurate budgeting.

11. You Can Always Rely on Your Home Equity

Counting on home equity as your primary retirement asset is risky. Housing markets can be unpredictable, and accessing home equity isn’t always easy or cost-effective. While home equity can be part of your retirement plan, it shouldn’t be the only pillar supporting your financial future.

12. Retirement Planning Can Wait Until You’re Older

The earlier you start planning for retirement, the better off you’ll be. Early planning allows for more time to adjust strategies, recover from market downturns, and benefit from compound growth. Even small steps in your 20s and 30s can have a significant impact on your retirement readiness.

13. You Need to Pay Off All Debt Before Retiring

While being debt-free in retirement is ideal, it’s not always necessary or possible. Low-interest mortgages or student loans might be manageable in retirement. The key is to eliminate high-interest debt and have a plan for managing any remaining obligations without straining your retirement income.

14. An Inheritance Will Solve Your Retirement Worries

Counting on an inheritance for your retirement is a gamble. Family circumstances can change, and the amount you receive might be less than expected. Unexpected medical costs or market downturns could also affect potential inheritances. It’s best to plan your retirement as if no inheritance is coming.

15. You Can’t Save Enough if You’re Not Making Six Figures

You don’t need a huge salary to build a substantial retirement nest egg. Consistent savings, even in small amounts, can add up over time. Take advantage of employer matches, tax-advantaged accounts, and smart budgeting to maximize your savings at any income level.

16. Retirement Means You Have to Stop Working Completely

The all-or-nothing view of retirement is outdated. Many retirees find fulfillment and financial benefits in part-time work, consulting, or turning hobbies into income streams. Phased retirement or a second career can provide both purpose and additional financial security.

17. You’ll Be in a Lower Tax Bracket in Retirement

Assuming you’ll automatically be in a lower tax bracket in retirement can lead to surprises. Required minimum distributions, pension payments, and Social Security benefits can push you into a higher bracket than expected. Tax planning should be an ongoing part of your retirement strategy.

18. Your Spending Patterns Won’t Change in Retirement

Many people assume their current spending habits will continue into retirement. In reality, expenses often shift. Some costs may decrease, while others, like healthcare or leisure activities, might increase. Regular reviews and adjustments to your retirement budget are essential.

19. You Don’t Need a Financial Advisor

While it’s possible to manage your own retirement planning, a financial advisor can provide valuable insights and strategies. They can help navigate complex tax laws, investment options, and retirement scenarios. Consider consulting with a professional at key life stages or for specific financial challenges.

20. A Good Investment Strategy Never Changes

Set-it-and-forget-it doesn’t work for retirement planning. Your investment strategy should evolve as you age, your goals change, and market conditions shift. Regular reviews and adjustments to your investment portfolio are crucial for long-term success.

21. You Can Rely on Your Children for Support

Expecting your children to support you financially in retirement is risky and can strain relationships. It’s best to plan for financial independence. This approach ensures you’re not a burden on your children and allows you to help them if you choose to, rather than relying on their support.

22. Your Expenses Will Be the Same Every Year in Retirement

Retirement expenses often fluctuate year to year. You might spend more in early retirement on travel and hobbies, then less in middle retirement, and potentially more again later due to healthcare costs. Plan for varying expenses and build flexibility into your retirement budget.

23. You Don’t Need an Emergency Fund in Retirement

Emergencies don’t stop when you retire. Unexpected home repairs, medical bills, or family needs can still arise. Maintain an emergency fund in retirement to avoid dipping into your retirement accounts for unplanned expenses, which could trigger taxes or penalties.

24. It’s Too Late to Start Saving if You’re Close to Retirement

While starting early is ideal, it’s never too late to improve your retirement outlook. Even if retirement is just a few years away, you can still make meaningful progress. Maximize catch-up contributions, reassess your budget, and explore ways to reduce expenses or increase income in retirement.

14 Pieces of Outdated Money Advice That Can Derail Your FIRE Plan

FIRE – Financial Independence, Retire Early. That’s the dream, right? Quit the rat race and live life on our own terms. It’s totally doable. Plenty of people join the FIRE movement and manage to retire pretty quickly. And there’s a LOT of advice out there on how to do it. Sadly, much of the advice is outdated or just plain bad.

12 Money Mistakes That Can Leave You Vulnerable in a Crisis

In times of uncertainty, financial stability is more crucial than ever. While prepping for physical emergencies is vital, don’t overlook financial prepping. Avoiding these common money mistakes can help make sure you’re in a stronger position to weather any storm.

Surviving the Crash: 17 Hot Takes on Crypto in a Post-Collapse World

With recent global unrest and economic uncertainties, many people are starting to worry about the stability of our money. They’re looking for new options like cryptocurrencies. Using digital money might sound strange, but it’s becoming more common. Big names like Bitcoin and Ethereum are leading the way. This article will look at how cryptocurrency could change things in a shaky economy. We’ll discuss the good and bad sides of using digital money. Get ready to learn about the crypto world and how it might affect our financial future!