Millionaires can crash and burn just like anyone else, but when they fall, it’s often spectacular. Whether through poor business choices, extravagant lifestyles, or illegal actions, many millionaires have watched their wealth vanish. Here are stories of 17 millionaires, including Jordan Belfort and Dennis Rodman, who faced severe financial collapse. Read on to find out how they lost it all.

Eike Batista

Once Brazil’s richest man, Eike Batista was worth $30 billion in 2012. His wealth evaporated due to a severe downturn in the mining industry and the collapse of his oil company, OGX. By 2014, his net worth had plummeted to negative figures, making it one of the most dramatic financial falls in history.

Denise Rossi

Denise Rossi won $1.3 million in the California Lottery in 1996 but chose to keep it secret from her husband. She quickly filed for divorce, pushing for a fast settlement. When her husband discovered the hidden winnings, a judge awarded him the entire prize for her failure to disclose assets.

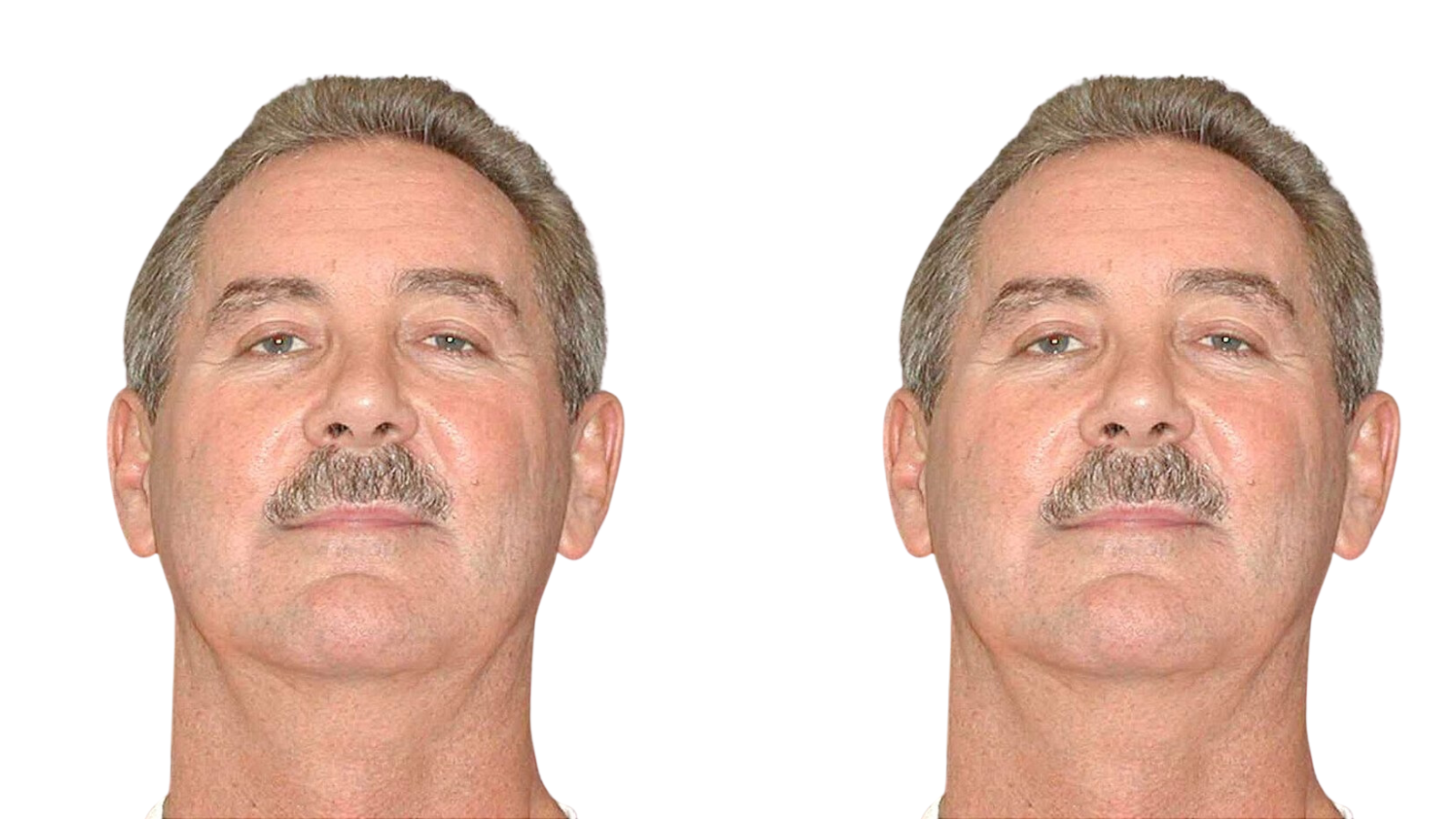

Allen Stanford

Allen Stanford, chairman of Stanford Financial Group, spent 20 years defrauding investors. Using his offshore bank in Antigua, he sold certificates of deposit and misused the funds for personal ventures. In 2009, the U.S. Securities and Exchange Commission charged him with running a massive fraud. By 2012, he was found guilty of $7 billion in fraud and sentenced to 110 years in prison.

MC Hammer

MC Hammer, once a top hip-hop artist, squandered around $30 million in earnings and filed for bankruptcy in the mid-1990s. His financial troubles stemmed from a huge entourage costing $500,000 a month and a $30 million mansion that he sold at a significant loss.

Jordan Belfort

Jordan Belfort, owner of Stratton Oakmont, made millions using high-pressure sales tactics to defraud investors. However, in 1992, the U.S. Securities and Exchange Commission stepped in. Belfort left the company two years later, and by 1996, it was shut down. Found guilty of securities fraud and money laundering, Belfort was sentenced to four years in prison, banned from the securities industry for life, and fined $110 million. His story inspired the movie “The Wolf of Wall Street.”

Vijay Mallya

Vijay Mallya, the flamboyant Indian liquor tycoon, owned Kingfisher Airlines. His lavish lifestyle and poor business decisions led to enormous debts. In 2012, he defaulted on loans and fled to the UK to avoid charges of bank fraud and money laundering amounting to about $1.3 billion. His attempts to evade extradition have been ongoing.

Curt Schilling

Baseball star Curt Schilling earned over $114 million during his career but lost everything investing in a video game company, 38 Studios. The company’s financial troubles, exacerbated by political scrutiny, led to its collapse. Schilling admitted to losing all his baseball earnings.

Sean Quinn

Sean Quinn, once Ireland’s richest man, lost his fortune through bad investments in Anglo Irish Bank. The 2008 financial crisis forced a government bailout. Accused of hiding assets, Quinn declared bankruptcy in 2012 after serving a short prison sentence for contempt.

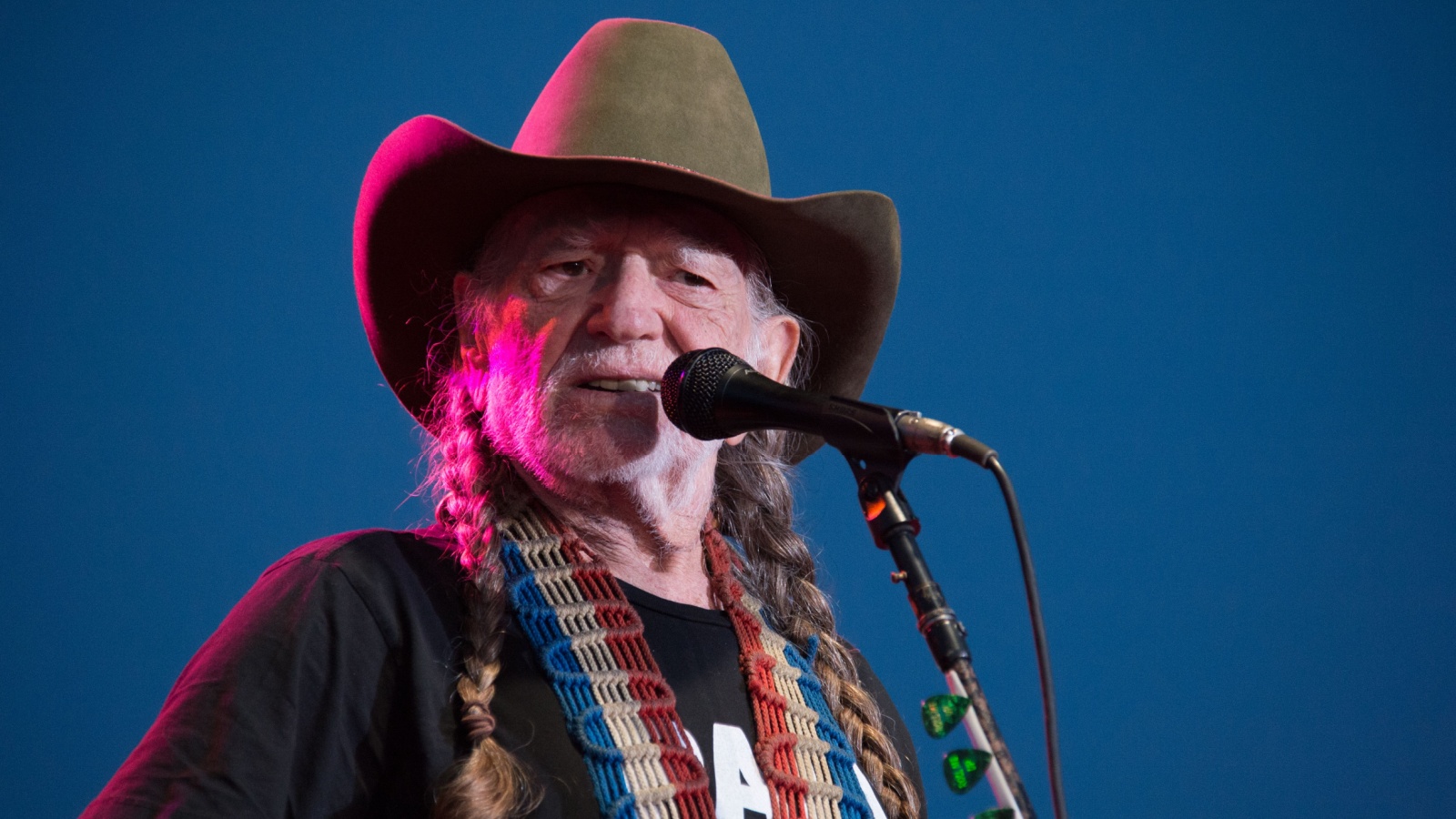

Willie Nelson

Country music legend Willie Nelson found himself in deep financial trouble in the early 1990s, owing $16.7 million to the IRS. The government seized his assets, but Nelson managed to pay off his debts by releasing an album, “The IRS Tapes: Who’ll Buy My Memories,” with all proceeds going to the IRS. By 1993, his debts were cleared.

Mark Brunell

Despite earning $50 million during his NFL career, quarterback Mark Brunell filed for bankruptcy with $25 million in debt. His downfall was due to poor investments, including failed real estate projects and a loss in a Whataburger franchise.

Nicolas Cage

Actor Nicolas Cage earned millions but spent excessively on eccentric items like shrunken pygmy heads and a haunted house. His spending habits, coupled with several foreclosures and a $6 million IRS bill, led to significant financial troubles.

Elizabeth Holmes

Elizabeth Holmes founded Theranos, a blood-testing company once valued at $9 billion. Accusations of misleading investors led to her net worth plummeting from $4.5 billion to nearly nothing. Theranos barely survives today, kept afloat by a $100 million loan from Fortress Capital.

Wesley Snipes

Actor Wesley Snipes made millions starring in movies like “Blade,” but he didn’t pay taxes from 1999 to 2004. Declaring bankruptcy in 2006, Snipes served three years in prison for tax evasion.

George Foreman

Retired boxer George Foreman faced financial ruin in the 1980s. His fear of bankruptcy drove him to return to boxing at age 45, where he regained the heavyweight title. This comeback helped him pay off millions in debt and led to the successful launch of his George Foreman Grills.

Manoj Bhargava

Manoj Bhargava, creator of 5-Hour Energy, pledged 45% of his profits to charity. Despite his good intentions, the product faced scrutiny from the FDA, which linked it to 13 deaths. This controversy, along with lawsuits, halved Bhargava’s net worth from $1.5 billion to $800 million.

Dennis Rodman

NBA legend Dennis Rodman earned $50 million during his career but faced financial ruin due to reckless spending and legal issues. In 2012, he was ordered to pay $500,000 in child support while battling an alcohol addiction.

Patricia Kluge

Patricia Kluge, ex-wife of Metromedia founder John Kluge, received a large divorce settlement and invested heavily in a vineyard. The real estate market crash led to overwhelming debt, and by 2011, she was bankrupt. Donald Trump eventually bought her vineyard for a fraction of its value.

14 Pieces of Outdated Money Advice That Can Derail Your FIRE Plan

FIRE – Financial Independence, Retire Early. That’s the dream, right? Quit the rat race and live life on our own terms. It’s totally doable. Plenty of people join the FIRE movement and manage to retire pretty quickly. And there’s a LOT of advice out there on how to do it. Sadly, much of the advice is outdated or just plain bad.

12 Money Mistakes That Can Leave You Vulnerable in a Crisis

In times of uncertainty, financial stability is more crucial than ever. While prepping for physical emergencies is vital, don’t overlook financial prepping. Avoiding these common money mistakes can help make sure you’re in a stronger position to weather any storm.

Surviving the Crash: 17 Hot Takes on Crypto in a Post-Collapse World

With recent global unrest and economic uncertainties, many people are starting to worry about the stability of our money. They’re looking for new options like cryptocurrencies. Using digital money might sound strange, but it’s becoming more common. Big names like Bitcoin and Ethereum are leading the way. This article will look at how cryptocurrency could change things in a shaky economy. We’ll discuss the good and bad sides of using digital money. Get ready to learn about the crypto world and how it might affect our financial future!